Managing payroll and tax forms is a critical responsibility for every employer. Among these, W-2 forms play a pivotal role in reporting employee wages and tax withholdings to the IRS. QuickBooks, being one of the most popular accounting and payroll software solutions, offers a streamlined approach to creating, managing, and filing W-2 forms. This guide provides a detailed walkthrough on handling W-2 forms in QuickBooks, ensuring compliance, accuracy, and efficiency.

First, discover how to prepare W-2 forms in QuickBooks; then, learn how to print and file them accurately. Additionally, call +1-866-500-0076 for expert QuickBooks support today

Understanding W-2 Forms

A W-2 form is an essential IRS tax document because it reports an employee’s annual wages and the taxes withheld from their paycheck. Therefore, employers are required to provide W-2 forms to each employee and, in addition, submit them to the Social Security Administration (SSA) annually.

Key components of a W-2 form include:

-

Employee information (name, address, Social Security Number)

-

Employer information (name, address, Employer Identification Number)

-

Total wages, tips, and other compensation

-

Federal, state, and local tax withholdings

-

Social Security and Medicare contributions

Accurate W-2 forms are crucial to avoid penalties and ensure employees can file their tax returns correctly.

Why Use QuickBooks for W-2 Forms

QuickBooks simplifies payroll management and W-2 form generation, offering multiple advantages:

-

Automated Calculations: QuickBooks automatically calculates employee wages, tax withholdings, and deductions.

-

Time Efficiency: The software saves time by allowing batch processing of W-2 forms.

-

Compliance Assurance: QuickBooks ensures W-2 forms meet IRS standards and deadlines.

-

Error Reduction: Integrated payroll features minimize manual entry mistakes.

-

E-Filing Capability: Employers can e-file W-2 forms directly with the IRS through QuickBooks.

With these features, businesses can streamline their payroll operations and focus on growth.

Read Also: İnternet kumarhane bonuslar ile: Hot Slice yenileme için bonus

How to Create W-2 Forms in QuickBooks

Creating W-2 forms in QuickBooks involves a systematic approach. Here’s a step-by-step guide:

Step 1: Verify Employee Information

Before generating W-2 forms, ensure all employee data is accurate. Check:

-

Full legal names

-

Social Security numbers

-

Addresses

-

Payroll details

Incorrect employee information can lead to IRS penalties, so take the time to verify these details.

Step 2: Set Up Payroll in QuickBooks

To generate W-2 forms, payroll must be correctly configured:

-

Navigate to the Payroll section

-

Ensure all pay types, deductions, and tax withholdings are accurately entered

-

Confirm that payroll schedules are up-to-date

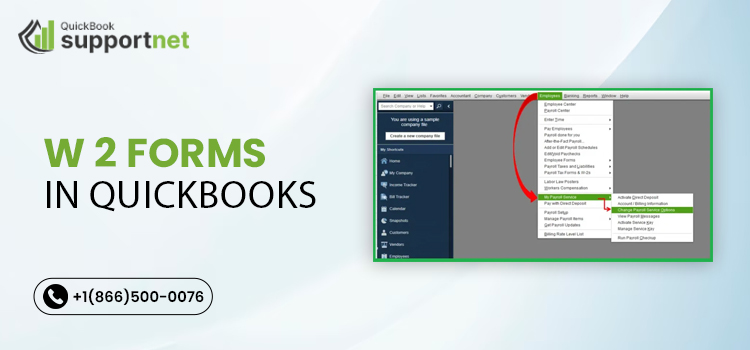

Step 3: Generate W-2 Forms

Once employee and payroll data are verified:

-

Go to the Employees menu in QuickBooks

-

Select Payroll Forms & Reports

-

Click on Annual Form W-2/W-3

-

Choose the year for which you want to generate W-2 forms

-

QuickBooks will automatically populate employee wage and tax data

Step 4: Review and Edit W-2 Forms

After generating the forms, review each W-2 carefully:

-

Ensure total wages match payroll records

-

Check federal and state tax withholdings

-

Correct any discrepancies immediately

Step 5: Print or E-File W-2 Forms

QuickBooks provides multiple options for distributing W-2 forms:

-

Printing: Print and mail W-2 forms to employees

-

E-Filing: File directly with the IRS using QuickBooks e-file options

For businesses that prefer guidance, QuickBooks customer support at +1-866-500-0076 can assist with any challenges during printing or e-filing.

How to Make W-2 Forms in QuickBooks

Making W-2 forms is slightly different from just creating them, as it involves configuring the form layout and ensuring compliance with IRS regulations:

-

Select the Correct Form Type: Choose W-2 (Copy A for IRS and Copy B for employees)

-

Choose Pre-Printed or Blank Forms: QuickBooks supports both options

-

Customize if Needed: Certain state-specific forms may require additional fields

-

Review for Accuracy: Use the QuickBooks preview function to verify before printing

QuickBooks’ built-in checks and validations help minimize errors, but professional support is available at +1-866-500-0076 for complex scenarios.

How Do I Print W-2 Forms in QuickBooks

Printing W-2 forms is a straightforward process but requires attention to detail:

1: Select the Employee(s)

-

Navigate to Employees > Payroll Forms & Reports

-

Choose W-2/W-3 Forms

-

Select the employees for whom you need to print W-2 forms

2: Choose the Year

-

Make sure the selected year matches your payroll data

3: Preview Forms

-

Check all totals and employee details

-

Correct errors if needed

4: Print the Forms

-

Load your W-2 paper (pre-printed or blank)

-

Select Print

-

Confirm printer settings and output quality

After printing, distribute W-2 forms to employees and keep a copy for your records. For seamless printing solutions and troubleshooting, contact +1-866-500-0076.

Common Issues with W-2 Forms in QuickBooks

Even with QuickBooks, some common issues may arise:

-

Incorrect Employee Details: Often caused by outdated records

-

Wrong Tax Calculations: Can occur if payroll setup is incomplete

-

Missing Payroll Data: Ensure all payroll periods are accounted for

-

Printing Errors: Printer or software settings may affect output

Proactive review of payroll and W-2 data is key. QuickBooks support is available to resolve any issues efficiently.

Tips for Managing W-2 Forms Efficiently

-

Maintain Updated Employee Records: Regularly update employee addresses and tax details

-

Verify Payroll Reports: Cross-check payroll summaries before generating W-2 forms

-

Set Deadlines: Generate W-2 forms well ahead of the January 31st IRS deadline

-

Use QuickBooks Payroll Alerts: Enable notifications to avoid missing forms

-

Consult Professionals: If unsure about calculations or e-filing, contact QuickBooks experts at +1-866-500-0076

Benefits of Filing W-2 Forms via QuickBooks

-

Time Savings: Automates tedious calculations and report generation

-

Accuracy: Reduces manual errors with integrated payroll data

-

Compliance: Ensures IRS and state reporting requirements are met

-

Employee Satisfaction: Provides timely and accurate W-2 forms to employees

QuickBooks combines convenience with reliability, making it the preferred choice for many small and medium-sized businesses.

Conclusion

Managing W-2 forms doesn’t have to be stressful. In fact, QuickBooks provides a complete solution for creating, printing, and filing W-2 forms with accuracy and compliance. Moreover, whether you are a small business or a growing enterprise, QuickBooks simplifies payroll tasks so that employees receive accurate W-2 forms on time. Therefore, using QuickBooks can save time and reduce errors in your payroll process.

Moreover, the software provides flexibility in distributing W-2 forms, whether by printing physical copies for employees or alternatively e-filing directly with the IRS. As a result, this dual approach saves time, enhances compliance, and ensures employees receive their forms promptly for accurate tax filing. In addition, QuickBooks allows for detailed reporting and review, thereby making it easier for businesses to verify data and maintain organized payroll records.

For additional support and guidance, businesses can call +1-866-500-0076. Experienced QuickBooks specialists are ready to assist with W-2 generation, printing, and e-filing issues. Additionally, visit quickbooksupportnet for detailed tutorials, tips, and resources to optimize your QuickBooks experience. By leveraging these tools, you can ensure seamless payroll management and stay compliant with IRS regulations.